Sophisticated construction contracts frequently contain a payment certification process, adding several procedural steps for the Contractor to receive payment from the Principal. Mostly seen by Contractors as an unnecessary deferral of payment, the true value to Contractors is often not understood.

A typical payment certification process

Payment certification should not be seen as abuse by the Principal

In a typical payment certification procedure, the Contractor is not allowed to submit a tax invoice unless it has gone through that process.

For this purpose, the Contractor must submit a request for payment after it has achieved a payment milestone or made progress. The request for payment is typically accompanied by documentation evidencing the achievement of the payment milestone or progress. While there is usually a time lag in preparing the request for payment, that time lag is within the control of the Contractor and can be shortened through the optimisation of contract administration processes.

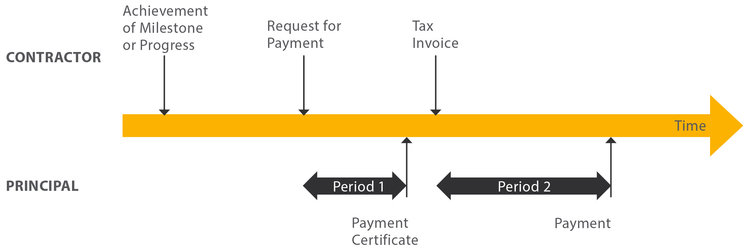

The request for payment must then be assessed by the Principal and be certified (in full or in part) for payment. The time the Principal takes in assessing a request for payment, as well as any call for additional information, is usually seen as onerous and highly undesirable by contractors (this period is marked as “Period 1” in the below chart).

Following receipt of the payment certificate, the Contractor issues a tax invoice in the amount of the payment certificate. If the payment certificate did not cover the full amount claimed in the request for payment, parties will need to resolve the dispute and, depending on the outcome, the Contractor may be able to invoice the disputed amount once the dispute is resolved.

The Principal makes payment against the tax invoice. The payment terms (marked as “Period 2” in the below chart) are mostly seen as an unavoidable delay and the number of days is usually subject to detailed negotiations.

But who benefits from the payment certification process?

Benefits for the Principal

The Principal has no doubt an interest in maintaining the payment certification process – and sometimes the main reason will be the delay it will cause to payment. However, the Principal also needs to ensure it is in funds for the required payment. In a project-financed environment, the Principal will involve the lenders in the payment certification (e.g. through an independent certifier or the lenders’ technical advisors). This ensures that lenders are in agreement with the outcome and will put the Principal in funds for the payment.

But what about the Contractor? While Period 2 seems to be unavoidable, most Contractors would prefer not to incur Period 1. Contractors will often argue that they would be happier to be able to simply submit their tax invoice.

Benefits for the Contractor

If a payment is disputed, payment certification will improve the Contractor’s liquidity

Contractors can enjoy cash flow benefits if they go through the payment certification process and payments are disputed. To demonstrate this, let us examine two scenarios.

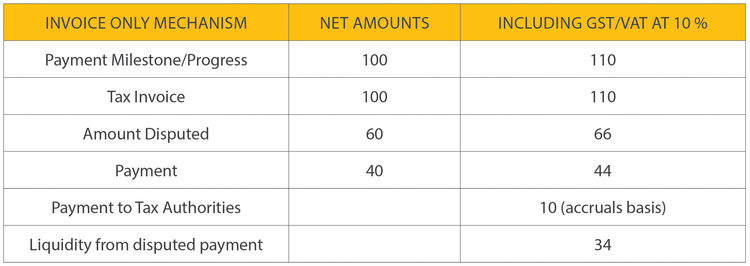

In the first scenario, the Contractor issues the tax invoice immediately with no payment certification process. If we assume that the Contractor pays GST or VAT (or similar sales tax) on an accruals basis, then it will need to pay tax on the full amount claimed in the tax invoice. If all or part of the amount claimed is disputed, the Contractor must – in the first instance – fund the tax on the disputed amount.

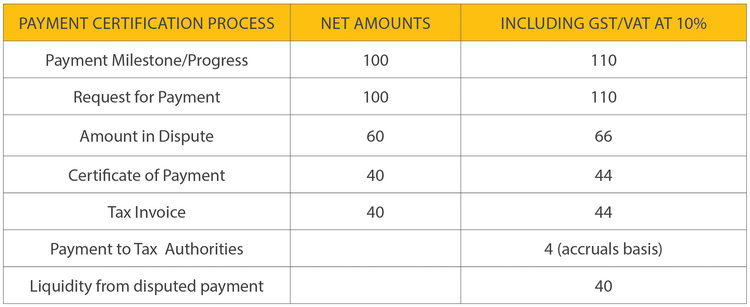

In the second scenario, the Contractor submits to a payment certification process. In this case, as it only issues a tax invoice for the undisputed amount, it will only pay tax on this amount. It does not need to fund the tax on the disputed amount until the dispute is resolved and the Contractor entitled to invoice a further amount.

Depending on the timing of the payment to the tax authorities and the rate of GST or VAT (or similar), the cash flow advantage for the Contractor can be very significant.

Where to from here

Contractors should embrace payment certification processes as they not only allow the Principal to finance a project, but also enable the Contractor to reduce the tax burden on disputed amounts. Parties should work collaboratively to clearly define payment milestones and streamline the process for payment certification to avoid unnecessary delay and potential abuse of the process.

In the next instalments of this series, we will explore the impact of payment certification on the availability of finance for the Contractor and the overlay created by various types of security of payment legislation.

For advice on construction law matters, please contact our Director Gerald Arends at Pegasus Legal. To find out more about Pegasus Legal and our experience in the construction and energy sectors, please visit www.pegasus-legal.com/experience.