The Philippine Renewable Energy Law provides for a VAT exemption that is meant to assist the deployment of renewables, but it makes life difficult for international specialists.

A VAT incentive

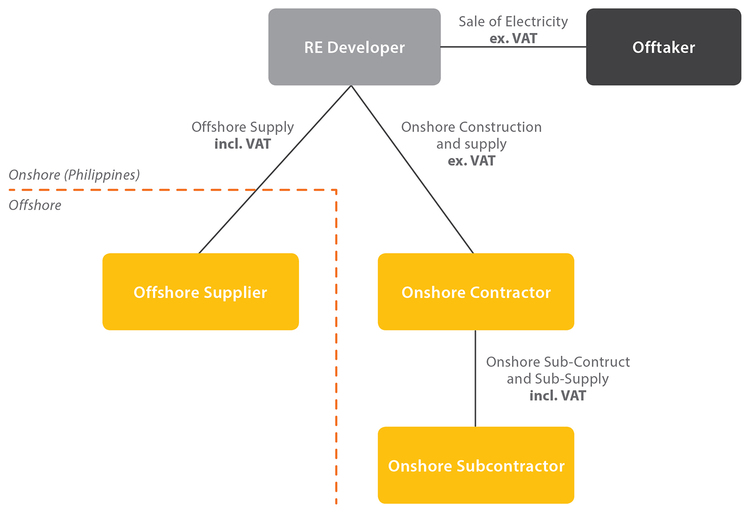

Under the Philippine Renewable Energy Law, registered developers of renewable energy projects in the Philippines (“RE Developers”) benefit from a zero-rated value added tax (VAT) on both their local supplies and on their sale of electricity to the offtaker. This means that the local contractor will not charge the RE Developer VAT on the construction cost and that the RE Developer does not need to charge the offtaker any VAT on the sale of electricity.

This is a very significant tax incentive in the Philippines: if the construction cost was to attract VAT, this would need to be pre-financed by the RE Developer. Market sources indicate that the recovery of such input tax from the Bureau of Internal Revenue may take up to 8 years if such recovery is possible at all. An offset of input tax credits against any output VAT (if the sale of electricity was subject to VAT) would be equally unattractive as such recovery would be stretched over many years.

The upshot of the Philippine Renewable Energy Law is that RE Developers do not need to raise finance for a 12 per cent. VAT component on their construction cost. Does this mean then that all is well?

VAT an incentive!

The VAT incentive suffers from two major flaws.

Zero-rated VAT only applies to the local component of the construction cost.

Typically (and the reasons are complex), projects are built under a supply contract from an offshore entity providing all the specialist equipment (ranging from solar modules to wind turbines) that are not locally available and a local construction contract. VAT is chargeable on the importation of equipment even if it is not locally available — leaving the RE Developer with a long recovery period for such input tax credit. Given the length of that recovery, it is often considered an absolute cost.

Zero-rated VAT only applies to the first tier of contracting by the RE Developer.

The local contractor providing construction (and any local equipment supply) services to the RE Developer is not required to charge VAT on such supply. Any sub-contractor providing goods or services to the local contractor must charge VAT on such sub-supply. This is not a problem if the local contractor has a healthy pipeline of non-renewable energy work where it can utilise the input tax credits.

It is a major problem for international contractors that either do not yet have a presence in the Philippines with projects other than renewables or for those international specialist contractors that only work in the field of renewables, who will never have the opportunity to utilise the input tax credits at all. VAT will be “stuck” in the first tier of contracting.

A growing market of utility-scale renewables in the Philippines needs large international contractors and specialist contractors to drive down the cost and provide expertise, but under the current regime these organisations need to treat VAT charged by their local suppliers and sub-contractors as an absolute cost.

VAT a shame, if you know what you are doing!

The VAT scheme applying to renewables was well-intended and is designed to deal with the flaws in the Philippine tax system where the recovery of input tax directly from the tax authorities is exceptionally prolonged. Unfortunately, its application penalises the very contractors that could help grow the Philippine renewable energy industry.